Offer the latest investment opportunities to your clients with Marquee’s mortgage REIT. Give clients less risk while boosting and diversifying investment strategies that earn fixed income.

As a financial advisor, you guide your clients’ financial decisions and provide them with unique and personalized alternative investment opportunities.

Private mortgage REITs were only available to a select inner circle previously but their popularity is growing. Marquee Funding Group has made its investor fund readily available to your clients.

Our mortgage REIT allows you to customize client portfolios based on risk, tolerance, and investment goals

It earns passive income while preserving capital, without management responsibility or complexity

It’s a unique alternative investment opportunity in real estate without the hassles of being a landlord

Real estate isn’t correlated to the stock and bond market, giving downside protection and likely better returns

Tap into the potential of private real estate markets that aren’t widely available, while investing in secure lending

Loans closed

2,300+

Aggregate loan volume

$3 billion+

Average coupon (unlevered)

9%+

Experience in private mortgage

30+ years

Dedicated in-house team and CPA

20+ team

We treat our investors and clients like family and believe in building deep-rooted connections.

To form exceptional partnerships, we’re a vertically integrated company that raises capital and sources loans in addition to managing all loan servicing, processing, and escrow in-house.

Marquee was founded on relationships. As long-term innovators in private real estate lending, our passion has allowed us to build more than 30 years in the business. Our entire team are partners and investors.

With core values of loyalty and exceptional customer service, we’re committed to the craft, the process, and working with you.

Our mortgage REIT funds private loans that are flexible but not speculative. Rather than close and churn deals, we finance responsible investments.

Marquee Funding Group provides full-circle servicing and adheres to the highest auditing standards, with the same level of duty of care and fiduciary responsibility you get from publically traded funds.

This level of care and services, in addition to our expertise in private money lending, makes investing with us a truly unique opportunity.

Fund Name: Marquee Capital Fund 1 LLC

Exemption: 506(c)

Target Return: 8% to 9.5%

Preferred Return: 8% annualized rate of return

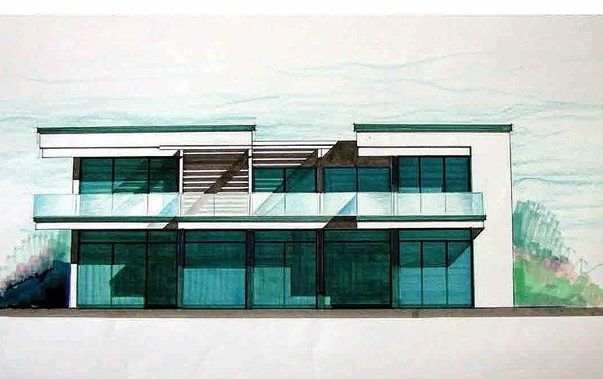

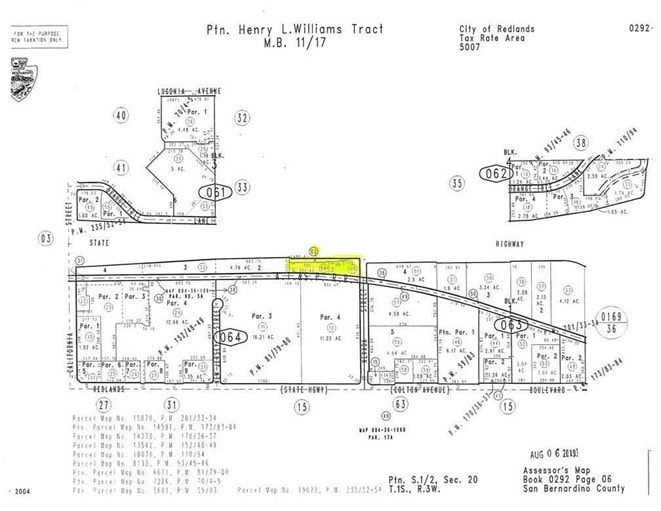

Our loans are secured by real estate and underwritten with the value of the assets and the borrower. Your clients benefit from these private financing deals with our quality borrower base to earn higher yields, quicker.

Loan Amount: $2,160,000

Interest Rate: 12%

Loan-to-value: 52.5%

Loan Position: 2nd

Location: Westlake Village

Loan Amount: $1,450,000

Interest Rate: 11.5%

Loan-to-value: 69.78%

Loan Position: 2nd TD

Loan Amount: $390,000

Interest Rate: 9.99%

Loan-to-value: 9.18%

Loan Amount: $600,000

Interest Rate: 9.75%

Loan-to-value: 42.85%

Loan Amount: $4,300,000

Interest Rate: 9.9%

Loan-to-value: 30%

Loan Amount: $1,000,000

Interest Rate: 12%

Loan-to-value: 54%

Loan Amount: $1,000,000.00

Interest Rate: 9.25%

Loan-to-value: 65%

Loan Term: 36 Months Interest Only

Loan Amount: $2,475,000

Interest Rate: 9.000%

Loan-to-value: 55%

Loan Term: 12 Months

Loan Amount: $1,500,000

Interest Rate: 8.000%

Loan-to-value: 50%

Loan Term: 10 Years

Loan Amount: $4,900,000

Interest Rate: 9.75%

Loan-to-value: 70%

Loan Term: 2 Years Interest Only Term

Loan Amount: $2,160,000

Interest Rate: 9.25%

Loan-to-value: 60%

Loan Term: 60 Months

Loan Amount: $400,000

Interest Rate: 9.5%

Loan-to-value: 68.85%

Loan Term: 36 Months

Loan Amount: $1,155,000

Interest Rate: 9.25%

Loan-to-value: 55%

Loan Term: 24 Months

Loan Amount: $10,500,000

Interest Rate: 8.75%

Loan-to-value: 50%

Loan Term: 60 Months

Financial advisors increasingly recommend these alternative investment opportunities because their clients often see higher returns than public funds while mitigating risks, earning fixed income, tapping into sound real estate investing, and even getting unique tax benefits.

Opportunities to finance private debt are growing as borrowers look for unique lending options to fit their wide array of needs. Institutional lending organizations like banks have to follow strict requirements that don’t always meet these needs and are often slow to close deals.

As the demand for flexible financing grows, there is more opportunity to invest in private debt to tap into the range of offerings private lenders provide, benefiting both borrowers and investors.

Private mREITs offer more downside protection compared to bonds. They protect against market downturns and offer an alternative investment opportunity for those looking to balance risk and diversify their portfolios.

The Marquee Capital Fund 1 relies on stringent borrower equity requirements that offer protection against market volatility. We use capital structure seniority for lower risk and higher priority for repayment. Loans financed by Marquee Funding Group are fully secured by high quality collateral, all of which make our private mortgage REIT low-risk to investors.

Over the long-term, private mortgage REITs hold well, potentially reaping higher returns as the real estate market matures. They are not correlated to the stock market or bond market and are less liquid than stocks so they see fewer volatile fluctuations in performance.

For Marquee Capital Fund 1 there is a 2-year lock-up for your investment before withdrawal is available to maintain stability.

Rather than trade shares daily, private mREITs earn passive income that requires less hands-on management.

Investors are entitled to a Qualified Business Income Deduction earned from trusts, including from REIT dividends.

Marquee Capital Fund 1 elects REIT status to deduct 20% of qualified REIT dividends from income tax returns so investors only pay taxes on 80% of dividends earned.

In addition to this direct benefit, a private mortgage REIT also provides the benefits of real estate investing without having to manage the legal and financial aspects of lending directly to borrowers. Investors avoid acting as property managers so don’t need to pay property taxes, purchase home insurance, or manage any other expenses of real estate investing.

Private lending investments come with risks if the lending itself isn’t sound. The main concern is that borrowers go into default on their loans and the money invested in their financing is at risk for investors. This is a result of poor underwriting. Often private lenders don’t use detailed qualification requirements to approve and finance loans.

Marquee Funding Group team has more than 30 years of experience in private lending and ensures that the detailed process to secure a loan with us benefits the borrower as much as it does our investors, preventing potential defaults. If a borrower does default, we use the same remedies as traditional banks to take the necessary steps toward foreclosure.

We fund private loans that are flexible but not speculative. Rather than close and churn deals, we finance responsible investments. Our full-circle servicing adheres to the highest auditing standards, with the same level of duty of care and fiduciary responsibility investors get from publicly traded funds.

Marquee Capital Fund 1 is on the Fidelity platform, which allows Registered Investment Advisors and investors to view the investment in their Fidelity portfolios.

Our Investor Portal also allows you to login to our Marquee Capital Fund 1 portal and Platinum Loan Servicing for further visibility.

AN INVESTMENT IN MARQUEE CAPITAL FUND 1, LLC INVOLVES RISK, AND NUMEROUS

FACTORS COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF

MARQUEE CAPITAL FUND 1, LLC TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS,

PERFORMANCE OR ACHIEVEMENTS THAT MAY BE EXPRESSED OR IMPLIED BY STATEMENTS

AND INFORMATION IN THIS REPORT. PLEASE REVIEW YOUR PRIVATE PLACEMENT

MEMORANDUM AND ANCILLARY DOCUMENTS WE PROVIDED TO YOU. FUTURE RESULTS

MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THIS REPORT, SHOULD ONE OR MORE

OF THESE RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD UNDERLYING ASSUMPTIONS

PROVE INCORRECT. PLEASE CONSULT YOUR LEGAL, FINANCIAL, AND TAX ADVISORS

REGARDING YOUR INVESTMENTS IN MARQUEE CAPITAL FUND 1, LLC.