These common loans can finance projects like buying, rehabilitating, and renting out one or multiple properties of different types.

Institutional loans and hard money loans differ in qualification requirements and timelines. Knowing their differences and choosing the best loan for your scenario will save you time and money.

Hard Money Loans 8.99%-12.99%

Financing is based on the value of the property you want to finance, as funding comes from private investors rather than a government-backed loan program. By focusing on the merit of the deal, rather than your credit score or certain property restrictions, approvals are fast and simple. Although interest rates are higher, term lengths are shorter and you can refinance to another loan type. *see disclosure at the bottom of page

HUD 223 (f) 2.4%-3.8%

HUD 223(f) is part of the US Department of Housing and Urban Development’s Federal Housing Administration Multifamily Housing program. It helps borrowers purchase or refinance existing multifamily rental housing, with limitations for properties that require substantial rehabilitation. It may require certain property conditions and repairs to be met before approving financing and comes with cash-out limitations, insurance premiums, and additional fees.

Freddie Mac Optigo 5.67%-5.97%

Government-sponsored Freddie Mac created Optigo to form a network of lenders who can finance projects beyond what conventional loans cover. This provides more options for specific investment scenarios but also involves extensive qualifications, added fees, and a long approval process. Loans can be used for the acquisition, refinance, or moderate rehabilitation of multifamily properties, including affordable, student, and senior housing.

HUD 221(d)(4) 3.15%-4%

Another of HUD’s FHA Multifamily Housing programs, HUD 221(d)(4) backs lenders in providing borrowers with financing for the new construction or substantial rehabilitation of multifamily rentals for moderate-income families, the elderly, and the handicapped. It has various limits related to rental unit sizes, structure types, and property location and often involves extensive documentation and a long approval process.

With hard money loans, private investors fund deals based on the value of your assets, rather than requirements set by the federal government. So hard money lenders don’t require the same strict qualifications as institutional lenders and can set a more flexible loan agreement.

Asset-based deals mean that the property itself is used as collateral and requirements adjust to match your scenario. This adaptability allows for speed, simplicity, and financing that meets your needs, including receiving funding in as little as seven days.

Flexible requirements do come with higher risks for the lender, so hard money loan rates are often higher than government-backed loans. However, many real estate investors prefer the quick cash flow of a hard money loan over the lengthy approval process for a lower rate.

Hard money loans also can have shorter term lengths so the interest is paid over less time than traditional loans. If you can’t pay off the loan that fast, you can refinance it to another loan type with a lower rate.

Interest rates for hard money loans are affected by the

housing market, as well as the amount of risk the lender

takes on by financing your deal. They want the deal to be a

success just like you do. These are the factors that can

affect hard money loan rates.

Please connect with a hard money lender to discuss the specifics of your scenario to get an accurate rate quote.

Knowing the benefits of a hard money loan gives you the confidence to choose the best financing. If you have questions or concerns in any of these areas, discuss them with Marquee Funding Group to learn more.

Loan Amount: $2,160,000

Interest Rate: 12%

Loan-to-value: 52.5%

Loan Position: 2nd

Location: Westlake Village

Loan Amount: $1,450,000

Interest Rate: 11.5%

Loan-to-value: 69.78%

Loan Position: 2nd TD

Loan Amount: $390,000

Interest Rate: 9.99%

Loan-to-value: 9.18%

Loan Amount: $600,000

Interest Rate: 9.75%

Loan-to-value: 42.85%

Loan Amount: $4,300,000

Interest Rate: 9.9%

Loan-to-value: 30%

Loan Amount: $1,000,000

Interest Rate: 12%

Loan-to-value: 54%

Loan Amount: $1,000,000.00

Interest Rate: 9.25%

Loan-to-value: 65%

Loan Term: 36 Months Interest Only

Loan Amount: $2,475,000

Interest Rate: 9.000%

Loan-to-value: 55%

Loan Term: 12 Months

Loan Amount: $1,500,000

Interest Rate: 8.000%

Loan-to-value: 50%

Loan Term: 10 Years

Loan Amount: $4,900,000

Interest Rate: 9.75%

Loan-to-value: 70%

Loan Term: 2 Years Interest Only Term

Loan Amount: $2,160,000

Interest Rate: 9.25%

Loan-to-value: 60%

Loan Term: 60 Months

Loan Amount: $400,000

Interest Rate: 9.5%

Loan-to-value: 68.85%

Loan Term: 36 Months

Loan Amount: $1,155,000

Interest Rate: 9.25%

Loan-to-value: 55%

Loan Term: 24 Months

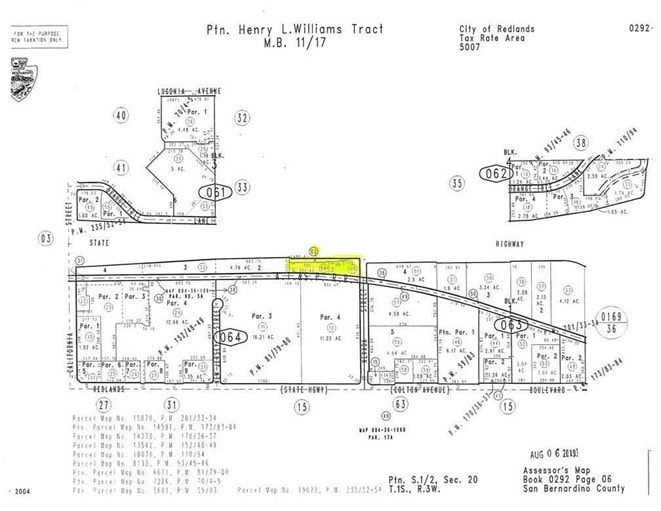

Loan Amount: $10,500,000

Interest Rate: 8.75%

Loan-to-value: 50%

Loan Term: 60 Months