Marquee Funding Group’s recently funded transactions show that hard money loans apply to a range of scenarios, providing financing for loans that others can’t.

Marquee Funding Group Funds $1,000,000 Private Money Loan in Beverly Hills.

Marquee Funding Group has successfully funded a $1,000,000 private money loan in Beverly Hills, California, further showcasing the firm’s expertise in structuring tailored financing solutions for unique borrower needs.

In this transaction, the loan proceeds were used to reimburse the borrower for funds already applied toward the property’s purchase, providing immediate liquidity while maintaining strong security for the lender. The loan was positioned as a second trust deed (2nd TD) at a 12% interest rate, offering an attractive yield to investors while accommodating the borrower’s financial strategy.

The deal was structured with a 64.87% loan-to-value ratio, striking a careful balance between borrower flexibility and lender protection. This conservative underwriting highlights Marquee’s ongoing commitment to aligning borrower objectives with sound lending practices.

By stepping in with private capital, Marquee enabled the borrower to free up resources without sacrificing momentum on their real estate investment. This type of creative financing is one of the hallmarks of private money lending, filling the gap where traditional lenders may not be able—or willing—to act.

The loan was originated by Maxwell Stone, whose expertise in structuring efficient solutions helped move the transaction forward quickly. His role underscores Marquee’s dedication to providing not only capital, but also experienced guidance throughout the lending process.

This Beverly Hills loan is another example of Marquee Funding Group’s ability to provide fast, reliable, and customized lending solutions across California and beyond. Whether for acquisitions, construction, or refinancing, Marquee continues to serve as a trusted partner for borrowers and a reliable opportunity for investors.

Marquee Funding Group Funds $850,000 Business Purpose Loan in Rancho Cucamonga.

Marquee Funding Group has successfully closed an $850,000 private money loan in Rancho Cucamonga, CA, structured to both support the borrower’s business operations and refinance an existing 1st trust deed. This transaction showcases Marquee’s ability to deliver flexible, fast capital to borrowers with complex financial needs while maintaining strong protections for investors.

The loan was secured at a 62.72% loan-to-value (LTV), ensuring a healthy equity cushion in the property. With a 10.5% interest rate and secured in a 1st trust deed position, the deal provided both the borrower and investors with a balanced solution—delivering liquidity for business growth while offering a solid risk-adjusted return.

Unlike traditional lenders, which often cannot accommodate borrowers requiring quick access to capital, Marquee Funding Group specializes in creating custom loan structures for unique situations. In this case, the borrower required funding that would both refinance an existing 1st TD and free up capital for ongoing business needs. By leveraging Marquee’s private lending platform, the borrower was able to achieve both objectives seamlessly.

Rancho Cucamonga, a growing city in Southern California’s Inland Empire, continues to see strong demand in both residential and commercial markets. This transaction reflects Marquee’s commitment to financing not only real estate acquisitions but also business-purpose loans that support entrepreneurial growth and financial flexibility.

With this deal, Marquee Funding Group once again demonstrated its position as a leader in private money lending, delivering creative financing solutions with speed and efficiency. By providing borrowers with access to capital that traditional banks cannot offer, Marquee continues to empower real estate investors and business owners while generating strong opportunities for its private lending partners.

Marquee Funding Group Closes $750,000 Purchase Loan in Ventura to Complete 1031 Exchange.

Marquee Funding Group has successfully funded a $750,000 purchase loan in Ventura, CA, designed to facilitate a 1031 Exchange transaction. This strategic financing highlights Marquee’s expertise in tailoring private money solutions to meet the needs of investors navigating time-sensitive real estate exchanges.

Structured at a 57.69% loan-to-value (LTV) and secured in a 1st trust deed position, this loan offered both strong security for the lender and flexibility for the borrower. With an 11.25% interest rate, the deal reflects the balance between competitive terms and expedited execution—hallmarks of Marquee’s private lending platform.

The borrower required immediate funding to complete the purchase as part of a 1031 Exchange, a transaction type that allows investors to defer capital gains taxes by reinvesting proceeds from one property into another. Given the strict deadlines imposed on 1031 Exchanges, timing is critical, and traditional lenders often cannot accommodate the expedited schedules required. Marquee’s ability to provide fast, customized funding solutions ensured the borrower met all requirements and successfully executed their investment strategy.

Ventura, a coastal city with a thriving real estate market, provided an ideal backdrop for this transaction. With strong property fundamentals and favorable equity levels, the loan represented a secure, well-structured deal benefiting both borrower and investor.

This closing underscores Marquee Funding Group’s reputation as a leading private money lender, offering creative financing for purchase transactions, refinances, bridge loans, and business-purpose deals. By providing efficient, asset-based solutions, Marquee enables investors to seize opportunities quickly—whether through 1031 Exchanges, cash-out refinances, or other tailored lending structures.

Marquee Funding Group Funds $1,135,000 Owner-Occupied Refinance Loan in LA.

Marquee Funding Group has successfully funded a $1,135,000 private money loan in Los Angeles, providing a borrower with the capital needed through an owner-occupied refinance. This transaction reflects Marquee’s continued ability to structure flexible lending solutions that meet unique borrower needs while maintaining strong protections for investors.

The loan was secured as a first trust deed (1st TD) with an interest rate of 10.625%, offering an attractive return to investors while delivering essential financing to the borrower. With a loan-to-value ratio of 66%, the deal provided the borrower significant access to equity while ensuring a well-secured position for the lender.

Refinance transactions such as this one demonstrate the advantages of private money lending. Unlike traditional lenders, Marquee Funding Group is able to move quickly, address borrower-specific circumstances, and deliver creative funding solutions that provide immediate results. For the borrower, this refinance offered the ability to restructure debt obligations and better position themselves financially.

The loan was originated by Eric Baehr, who played a key role in guiding the transaction to closing. His ability to align borrower needs with Marquee’s investor-focused underwriting standards highlights the firm’s expertise in managing complex deals with efficiency and precision.

This LA funding illustrates Marquee Funding Group’s reputation as a trusted private lending partner. By consistently delivering tailored loans for refinancing, acquisitions, construction, and business cash-outs, Marquee ensures both borrowers and investors benefit from each transaction.

With decades of experience and a strong commitment to reliability, Marquee Funding Group continues to stand out as a leader in private money lending, providing capital where it’s needed most and creating secure, high-yield opportunities for investors.

Private Money Loan Funds Investment Property Acquisition in San Fernando.

Marquee Funding Group recently closed a $1,975,000 private money loan in San Fernando, CA, structured to support the purchase of an investment property. This transaction exemplifies the firm’s ability to provide swift and flexible capital for real estate investors seeking tailored financing solutions.

The borrower required cash-out funds to complete the acquisition of the property. With traditional lending channels often limited by rigid requirements, Marquee Funding Group was able to step in with a creative financing approach that met the borrower’s needs and timeline. The loan was structured as a first trust deed, ensuring a secured position for the lender.

The loan carried an interest rate of 12% with a loan-to-value (LTV) ratio of 58%, offering a balanced structure that protected investor interests while still granting the borrower substantial capital access. This type of loan underscores Marquee’s niche expertise in bridging the gap where conventional financing may not be viable, particularly in competitive markets where timing is critical.

By leveraging private money, the borrower gained the flexibility to move forward with their investment property purchase without delay, positioning themselves strategically in the San Fernando real estate market. Such deals highlight the vital role of private capital in driving real estate growth and enabling investors to capitalize on opportunities that traditional lenders might overlook.

This successful closing further solidifies Marquee Funding Group’s reputation as a trusted leader in private money lending, capable of executing complex deals with speed, precision, and reliability.

Marquee Funding Group Funds $3,300,000 Business Purpose Cash-Out Refinance in Beverly Hills.

Marquee Funding Group recently closed a $3,300,000 private money loan, originated by RJ Solovy, to facilitate a business purpose cash-out refinance on a luxury property in Beverly Hills, CA. This transaction underscores Marquee’s expertise in structuring tailored lending solutions for borrowers who require speed, flexibility, and reliability outside of traditional financing channels.

The deal was structured with a 65% loan-to-value (LTV) ratio, ensuring solid protective equity in one of California’s most prestigious and resilient real estate markets. Despite being secured in a 2nd trust deed position, the loan carried investor confidence due to the strength of the collateral and the borrower’s profile.

The financing was delivered at a 13% interest rate, reflecting both the lien position and the unique requirements of the transaction. For the borrower, this refinance provided immediate access to significant capital that could be redeployed into business ventures or investment opportunities, without the lengthy delays typically associated with conventional lending.

Beverly Hills continues to be one of the most coveted markets in the United States, known for its stability, luxury properties, and consistent demand. The property’s location and high-value profile played a critical role in making this deal attractive for investors, even at a higher risk position.

This transaction highlights Marquee Funding Group’s ability to assess deals holistically—balancing borrower needs, asset strength, and market conditions to deliver financing that works for all parties. By securing favorable terms on a high-profile property, Marquee once again demonstrated why it is a leader in California’s private money lending market, offering solutions that traditional institutions cannot match.

Marquee Funding Group recently closed a $15,000,000 private money refinance secured by a luxury property in Malibu, California. This transaction highlights the group’s ability to deliver fast, flexible financing solutions for high-value real estate in competitive markets.

The borrower required a refinance on an existing note maturity, and Marquee was able to step in quickly to structure favorable terms. The deal was secured with a 1st Trust Deed position, ensuring a strong protective equity position for investors. With a conservative 60% loan-to-value ratio, the collateral provided substantial security on the investment, reflecting the quality of the Malibu property backing the loan.

The note carried a 10.5% interest rate, offering investors a strong return while giving the borrower the liquidity needed to refinance at maturity. These types of structured deals demonstrate how private money can provide an efficient alternative to traditional financing, especially for high-net-worth borrowers with time-sensitive requirements.

The transaction was originated by RJ Solovy, who continues to bring expertise and precision to Marquee’s portfolio of high-balance, private money loans. His focus on building strong borrower relationships and identifying well-secured opportunities helps create mutually beneficial outcomes for both clients and investors.

Malibu remains one of the most desirable real estate markets in California, known for its oceanfront estates and consistently high property values. Closing a $15 million refinance in this location further showcases the firm’s strength in handling complex, large-scale transactions.

This deal underscores Marquee Funding Group’s position as a leader in private money lending—delivering speed, security, and returns across luxury and investment-grade properties.

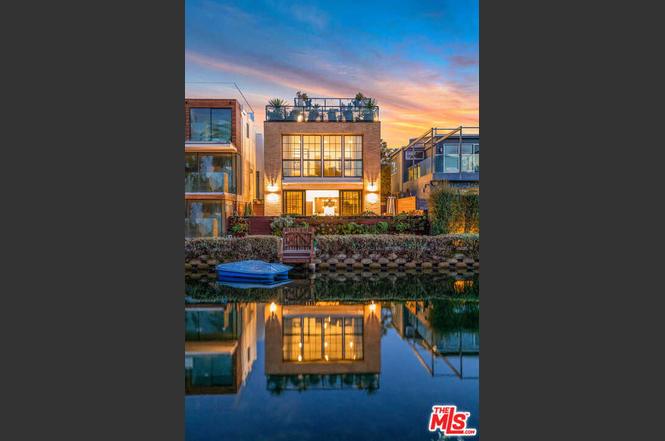

Marquee Funding Group Closes $3,490,000 Debt Consolidation Refinance in Venice Beach

Marquee Funding Group successfully closed a $3,490,000 private money loan, originated by RJ Solovy, to refinance and consolidate debt on a prime property in Venice Beach, California. This transaction was structured to pay off an existing, maturing first trust deed, allowing the borrower to secure long-term stability and continued control of their property in one of Los Angeles’ most dynamic coastal communities.

The deal was funded at a 66.48% loan-to-value (LTV) ratio, reflecting both a healthy equity cushion and the high market value of Venice Beach real estate. Structured as a 1st trust deed, the loan offered strong security for investors while meeting the borrower’s immediate need for capital.

The loan carried an interest rate of 10.875%, reflecting market pricing for private debt consolidation solutions. While higher than conventional lending rates, the terms provided the borrower with flexibility, speed, and certainty—key advantages in a private lending transaction. By consolidating multiple debts into a single note, the borrower reduced financial pressure and avoided the risk of losing equity tied to the maturing loan.

Venice Beach is a globally recognized market, combining high property demand, cultural appeal, and limited housing supply. These market fundamentals make transactions in the area attractive to investors, even at higher leverage or tighter timeframes.

This loan highlights Marquee Funding Group’s ability to deliver creative financing solutions that balance borrower needs with investor confidence. By acting quickly and structuring a refinance that consolidated obligations, Marquee not only safeguarded the borrower’s ownership but also provided investors access to a well-secured loan in one of Southern California’s most desirable real estate markets.

Marquee Funding Group Funds $10,500,000 Refinance in Los Angeles

Marquee Funding Group has closed a $10,500,000 refinance for a luxury property located in Los Angeles, California, showcasing its expertise in delivering customized private money lending solutions for high-value assets.

The financing was structured in a 1st trust deed position with a loan-to-value (LTV) ratio of 52.5% and a competitive 10% interest rate. This refinance was arranged to pay off a matured private 1st trust deed loan, providing the borrower with a seamless transition and stability while preserving equity in the property. By stepping in quickly and decisively, Marquee ensured the borrower avoided disruptions that could have arisen from a maturing loan.

In today’s lending environment, borrowers with unique financing needs often face challenges with traditional banks, which can be slow-moving and rigid in their requirements. Marquee’s ability to step into large transactions such as this refinance reflects its agility and commitment to providing practical solutions when conventional options are not viable.

Los Angeles remains one of the most desirable real estate markets in the country, with luxury properties often requiring bespoke financing arrangements. Marquee’s private lending platform is uniquely positioned to meet this demand, offering borrowers access to significant capital with flexible structures tailored to each transaction.

This deal highlights Marquee Funding Group’s reputation as a trusted partner in large-balance private lending, capable of addressing complex financing situations with speed and precision. For borrowers managing substantial real estate portfolios, Marquee continues to demonstrate its value in delivering liquidity solutions that align with both immediate needs and long-term strategies.