Why would investors want to reinvest their dividends rather than take them as income?

Because if they reinvest, they get to tap into the magic of compounding.

If you’re an investor focused on building wealth, don’t overlook the power of dividend reinvestment.

Read on to learn how reinvesting dividends works and why investing in Marquee Capital Fund 1 pays off.

Let’s Start Investing

What are dividends?

When investors purchase shares in a fund, they are entitled to a portion of the profits.

This “portion” is known as dividends, which can be taken as cash or reinvested to purchase additional shares.

Dividends attract long-term investors because they can grow over time through compounding.

Types of dividends

There are two main types of dividends:

- Cash dividends: Distributed to shareholders as cash and provide immediate income that can be reinvested or withdrawn

- Stock dividends: Paid in the form of additional shares or units, allowing investors to benefit from capital appreciation over time and the potential for greater returns.

How Marquee Capital Fund 1 generates income for its investors

Marquee Capital Fund 1 is a private mortgage REIT that provides investors with an alternative way to earn passive income through private real estate investing.

The fund generates income by lending to real estate investors, offering high-yielding, fixed-income opportunities without the risks associated with direct real estate ownership, such as being a landlord.

Investors in the Fund receive regular dividend payouts from the fund’s lending activities, with a return of roughly 8%.

The power of reinvesting dividends

Reinvesting dividends rather than withdrawing them as cash increases the number of shares you own. It boosts the compounding effect, where your investment earns returns on both the original capital and the reinvested dividends.

The process of reinvesting dividends is straightforward:

- When a company pays dividends, you reinvest rather than take the cash.

- The reinvested dividends are used to purchase additional shares.

- The number of shares you own increases, providing larger future dividend payouts.

- These larger dividend payouts are reinvested, compounding your returns.

The more frequently dividends are paid and reinvested, the faster your investment can grow.

Growth example from Marquee Capital Fund 1

Imagine you begin with an initial investment of $100,000 in Marquee Capital Fund 1, which offers an 8% preferred return.

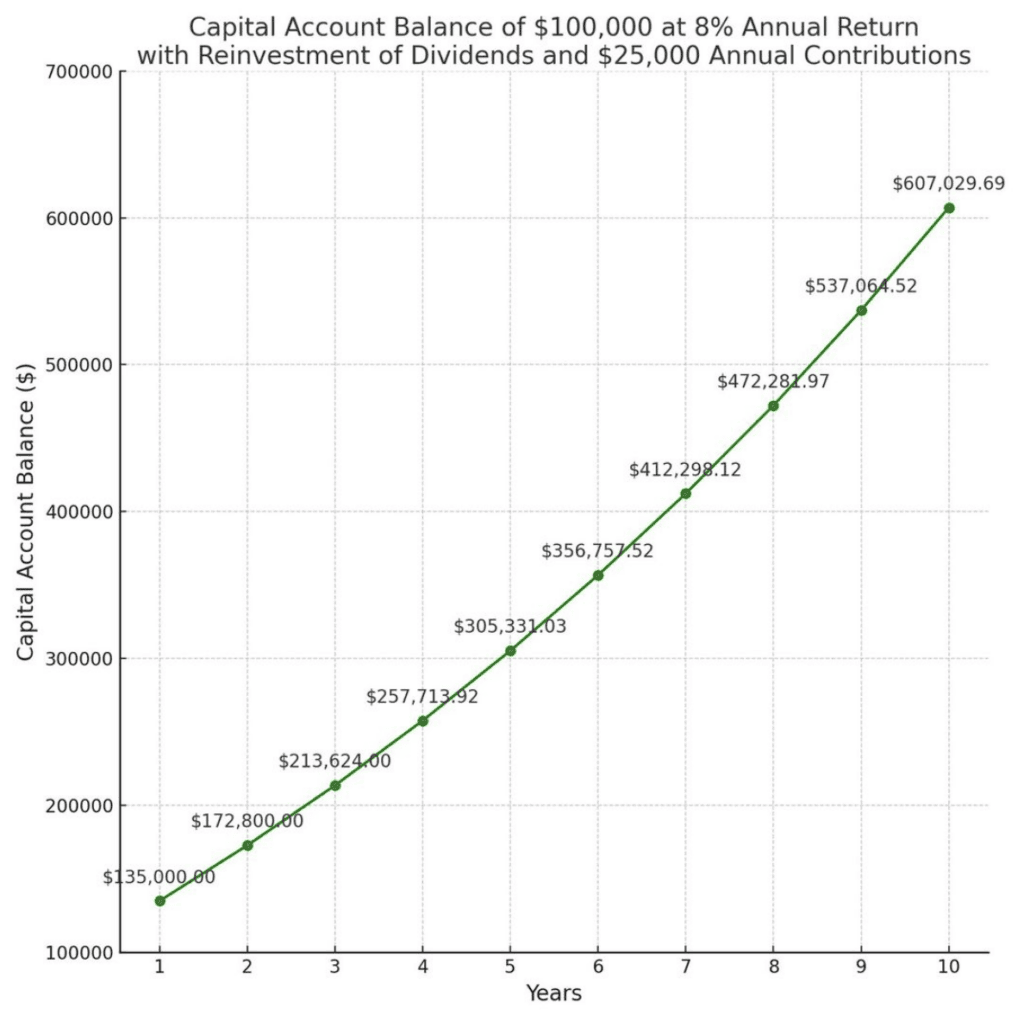

Look at the growth chart below for this hypothetical example, which illustrates how reinvesting dividends and adding regular contributions can result in substantial portfolio growth.

Starting with $100,000, reinvesting dividends with an 8% return, and contributing $25,000 annually, the investment grows exponentially over 10 years.

The investment has grown to over $600,000 by the decade’s end.

Benefits of reinvesting dividends

Reinvesting dividends isn’t right for every strategy, but it is among the most effective long-term wealth-building strategies.

Let’s examine the key benefits of reinvesting dividends to determine whether this strategy would work for your unique investment goals.

Compounding growth

The beauty of compounding is that the longer it is allowed to work, the more powerful it becomes.

Over time, every reinvestment can potentially create returns on the original capital and the reinvested dividends.

Maximizing returns

By choosing to reinvest rather than withdraw, investors can experience the full earning potential of their dividends.

Without reinvesting, you only benefit from the initial capital appreciation and can miss out on significant growth potential.

Consistent contributions

Regular contributions result in dual growth: You add new capital while compounding the returns from your reinvested dividends.

Reinvesting dividends, compounding growth, and making consistent contributions is a powerful strategy that can transform your initial sum into an impressive portfolio.

Potential challenges and risks

Every investment strategy has some level of risk, depending on the investor’s needs and goals.

Let’s take a look at the potential downsides of reinvesting dividends to help you make the most informed decision.

Market volatility

Even when reinvesting dividends, investors are still exposed to market fluctuations and potentially losing their initial investment.

For example, real estate markets can shift, borrowers can default, and economic conditions can change.

In efforts to curb these risks, Marquee Capital Fund 1 works to limit investor exposure through the following approach:

- Prudent underwriting that looks beyond basic metrics for the full story and true valuations

- Scrutinizing loan applications for the quality of collateral, verification of title, and borrower financials and ability to repay

- Loans are screened and underwritten by licensed professionals emphasizing principal and yield preservation.

- Diversification via a pool of mortgage-backed securities

- Investing in various mortgage products and property types throughout the U.S.

We adhere to the highest auditing standards, with the same duty of care and fiduciary responsibility you get from publically traded funds.

Past performance doesn’t guarantee future results

Investors should understand that even if a fund has historically provided solid returns, it may not perform at that same level indefinitely.

As previously noted, market conditions, economic cycles, and changes in the specific investment landscape can all impact future performance.

Working with a financial advisor before making any major investment decisions may be helpful.

They can help you ensure that the investment aligns with your current and future needs, outline the range of potential risks involved, and suggest ways to offset them.

Get started with Marquee Capital Fund 1

Interested in investing in real estate without the hassle of managing properties yourself?

Marquee Capital Fund 1 offers investors an opportunity to earn passive income while preserving capital and benefiting from diversified real estate-backed lending.

Ready to take control of your financial future? Accredited investors can start here with Marquee Funding Group!