Marquee Funding Group’s recently funded transactions show that hard money loans apply to a range of scenarios, providing financing for loans that others can’t.

Marquee Funding Group has successfully funded a $1,500,000 loan for the purchase of an owner-occupied single-family residence (SFR). This transaction showcases Marquee’s expertise in delivering tailored private money financing solutions for homeowners who require speed, flexibility, or unique loan structures that traditional lenders often cannot provide.

The loan was structured with an 8% interest rate, a 50% loan-to-value ratio, and a 10-year term. The conservative LTV ensures strong security for investors while allowing the borrower to retain significant equity in their property. The long-term structure of the loan provides stability, with predictable payments designed to support the borrower’s long-term homeownership goals.

Owner-occupied SFR financing is often challenging for borrowers who do not fit into conventional underwriting standards—whether due to income verification issues, timing constraints, or other unique circumstances. Marquee Funding Group specializes in filling this gap, offering private money solutions that deliver both speed and flexibility.

By providing this $1.5M loan, Marquee enabled the borrower to secure their new residence with confidence, avoiding the delays and restrictions of traditional mortgage channels. For investors, the conservative 50% LTV and the security of a primary residence as collateral created an attractive, well-protected opportunity.

Marquee Funding Group recently funded a $4,900,000 private money loan secured by a San Diego vacation rental property. This transaction underscores Marquee’s ability to provide flexible financing for income-producing properties in highly competitive short-term rental markets.

The loan was structured with a 9.75% interest rate, a 70% loan-to-value ratio, and a two-year interest-only term. The structure provides the borrower with lower monthly payments and maximum flexibility while they manage and optimize their vacation rental operations. For investors, the conservative underwriting and strong collateral backing ensure a secure position with attractive returns.

San Diego remains one of the nation’s top vacation rental destinations, attracting millions of visitors each year. The strength of the rental market, combined with rising property values, makes access to timely financing essential for investors looking to capitalize on opportunities. Traditional banks, however, often hesitate to fund short-term rental properties due to usage restrictions and strict underwriting requirements.

Marquee Funding Group fills this gap by offering tailored private money loans designed for investment and hospitality-focused real estate. This $4.9M loan gave the borrower fast access to capital, enabling them to move forward confidently in one of California’s most desirable rental markets.

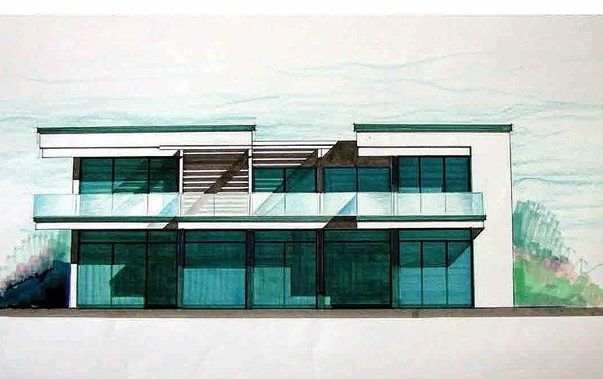

Marquee Funding Group has successfully funded a $2,160,000 purchase and construction loan in Malibu, California. This transaction highlights Marquee’s ability to provide comprehensive financing solutions that cover both property acquisition and construction, enabling borrowers to move forward confidently on high-value projects.

The loan was structured with a 9.25% interest rate, a 60% loan-to-value ratio, and a 60-month term. This combination gives the borrower a balance of security and flexibility—delivering the capital needed to purchase the property and complete construction, while providing ample time to execute the project and plan for an eventual refinance or sale.

In markets like Malibu, where demand for luxury residential properties remains strong, timing and creativity in financing are crucial. Traditional lenders often hesitate to fund construction projects, especially those tied to purchases, due to the added complexity and perceived risk. Marquee Funding Group specializes in filling this gap by offering customized private money loans that account for both acquisition and build-out, ensuring that projects can advance without delays.

Marquee Funding Group recently funded a $400,000 loan for the purchase of an owner-occupied second single-family residence (SFR) in Pacific Palisades, California. This transaction highlights Marquee’s expertise in delivering flexible private money financing for borrowers with unique circumstances that fall outside the rigid criteria of traditional lenders.

The loan was structured with a 9.5% interest rate, a 68.85% loan-to-value ratio, and a 36-month term. With nearly 30% equity remaining in the property, this deal offered strong security for investors while enabling the borrower to secure financing quickly and efficiently.

Owner-occupied second homes often pose challenges for conventional financing. Lenders typically impose stricter requirements for income verification, reserves, and usage, which can delay or even derail a purchase. Marquee Funding Group bridges this gap by offering private money solutions that provide borrowers with timely access to capital while ensuring well-structured deals that protect investors.

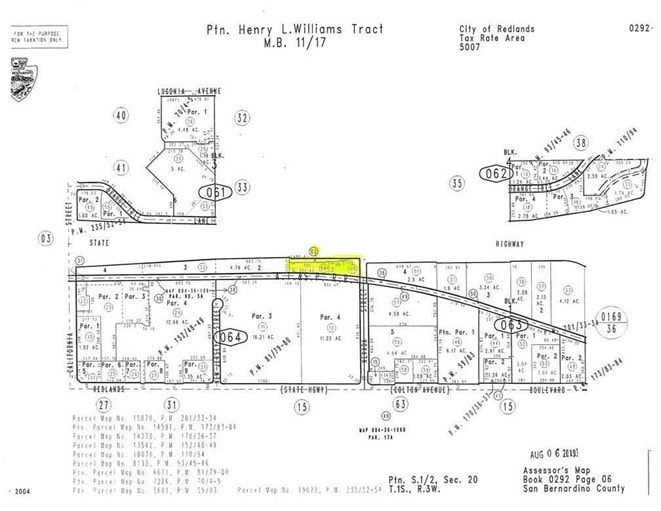

Marquee Funding Group recently funded a $1,155,000 loan for the purchase of a commercial/industrial vacant lot. This transaction showcases Marquee’s ability to provide private money financing for property types that traditional banks often decline, particularly when it comes to raw land acquisitions with commercial or industrial potential.

The loan was structured with a 9.25% interest rate, a 55% loan-to-value ratio, and a 24-month term. With nearly half of the property value retained as equity, the deal presented strong security for investors while offering the borrower the capital necessary to seize a strategic land acquisition opportunity.

Vacant commercial and industrial lots are frequently overlooked by conventional lenders due to their lack of immediate income production and the perceived risk tied to future development. However, these properties often carry significant potential for long-term growth, redevelopment, or repositioning. Marquee specializes in identifying and funding these opportunities by offering creative, flexible financing solutions that allow borrowers to move forward quickly.

Marquee Funding Group has successfully funded a $10,500,000 loan for a luxury estate located in the exclusive Yellowstone Club in Big Sky, Montana. This transaction underscores Marquee’s ability to structure large-scale private money loans for high-value properties in premier markets where speed, flexibility, and creativity are essential.

The loan was structured with an 8.75% interest rate, a 50% loan-to-value ratio, and a 60-month term. With half of the property value retained as equity, this deal represents a secure position for investors while providing the borrower with substantial capital to manage or expand their investment in one of the most prestigious private communities in the country.

The Yellowstone Club is renowned as a world-class, members-only community that features luxury residences, private ski slopes, and unmatched amenities. Properties in this market are highly sought after and often require financing solutions outside the scope of traditional banks. Conventional lenders may hesitate on large-scale luxury estates due to the loan size, borrower profile, or complex underwriting requirements.

Marquee Funding Group specializes in stepping into these scenarios with tailored private money solutions, delivering fast and reliable financing that aligns with both borrower goals and investor security. For the borrower, this $10.5M loan provided the capital and flexibility to maintain ownership and optimize the estate’s long-term value. For investors, the 50% LTV and tangible, high-value luxury collateral ensured a strong and secure lending opportunity.

This transaction highlights Marquee’s strength in funding luxury and high-net-worth real estate deals nationwide. By combining conservative underwriting with borrower-focused creativity, Marquee continues to deliver lending solutions that traditional institutions cannot match.