Marquee Funding Group’s recently funded transactions show that hard money loans apply to a range of scenarios, providing financing for loans that others can’t.

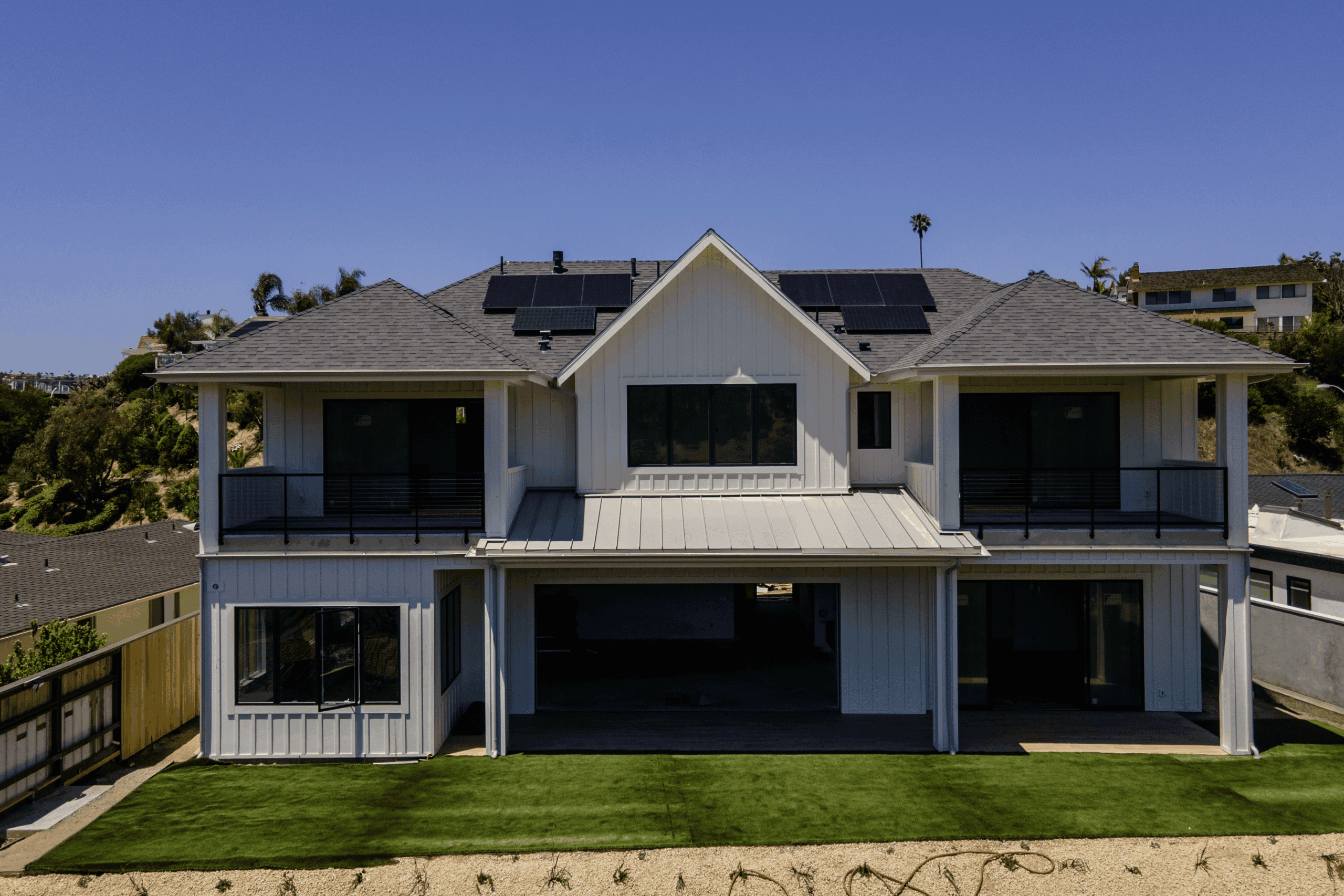

This was a loan to complete the construction of the subject property, which was a single-family spec home. We also built in payment, so they did not have to worry about the loan and could focus on the build. The borrower completed the project and has listed the property for sale.

Marquee Funding Group is proud to announce the successful funding of a $550,000 private money loan secured by a property in Rancho Mirage, California. This deal exemplifies Marquee’s continued commitment to helping business owners access fast, flexible, and purpose-driven financing through creative private lending solutions.

The loan was structured as a 1st trust deed with a 39.28% loan-to-value (LTV) ratio — a conservative structure that provides excellent security for investors while ensuring the borrower gains access to much-needed capital. The note carries an interest rate of 11.5%, reflecting a strong, risk-balanced investment with a steady return.

The proceeds from this loan will be used to support the borrower’s restaurant business, specifically providing working capital and reserves. These funds will help strengthen day-to-day operations and ensure the restaurant’s long-term financial health. Traditional bank financing can often be slow or restrictive for small business owners — particularly those in the hospitality industry. Marquee Funding Group stepped in to provide an efficient and practical funding solution tailored to the borrower’s business objectives.

This transaction was originated by Maxwell Stone, whose expertise and client-centered approach helped structure a deal that met the borrower’s immediate financial needs while maintaining Marquee’s disciplined underwriting standards. His work reflects Marquee’s ability to evaluate complex financial situations quickly and close loans that make sense for both borrowers and investors.

With this Rancho Mirage deal, Marquee Funding Group once again demonstrates the value of private money lending as a bridge between traditional banking and real-world business financing needs. By focusing on equity, speed, and common-sense underwriting, Marquee continues to empower borrowers and investors alike — delivering funding solutions that are both strategic and secure.

Marquee Funding Group is proud to announce the successful funding of an $850,000 private money loan in San Anselmo, California, highlighting our continued commitment to providing fast, flexible, and reliable financing solutions for business owners and investors.

This deal was structured as a 1st trust deed with a 30.3% loan-to-value (LTV) — an exceptionally low leverage position that offers strong security for investors and demonstrates the borrower’s significant equity stake in the property. The loan carries a 10% interest rate, creating an attractive yield for investors while maintaining a prudent risk profile.

The loan was designed as a Business Purpose Cash-Out Refinance, enabling the borrower to tap into their property’s equity to access capital for operational and investment needs. Unlike traditional bank financing, which often requires lengthy approval timelines and rigid underwriting, Marquee Funding Group’s private lending approach focuses on the value of the asset and the borrower’s business objectives — allowing for quick funding and practical financial solutions.

This transaction was originated by RJ Solovy, whose deep understanding of complex financial structures and client-centered service played a key role in executing the deal efficiently. His ability to navigate the nuances of private money lending reflects Marquee’s reputation as an industry leader in customized lending solutions.

By structuring deals like this one in San Anselmo, Marquee Funding Group continues to bridge the gap between conventional lending and real-world business needs. Through equity-based underwriting and a focus on speed, flexibility, and integrity, Marquee empowers borrowers to achieve their financial goals — while providing investors with well-secured, high-quality opportunities.

Marquee Funding Group is excited to announce the funding of an $870,000 private money loan in Pacific Palisades, California, showcasing our continued commitment to delivering flexible, fast, and creative financing solutions for real estate investors and developers.

This loan was funded through Marquee Capital Fund 1 and secured as a 1st trust deed, reflecting a strong, equity-based lending structure that provides both security for investors and opportunity for the borrower. With a 60% loan-to-value (LTV) ratio and a 10.5% interest rate, this deal strikes a well-balanced mix of risk mitigation and attractive yield — hallmarks of Marquee’s disciplined approach to private lending.

The borrower secured this loan to purchase and redevelop a burned-out lot, turning a distressed property into a valuable development opportunity. This type of project underscores the vital role private money plays in revitalizing communities and driving real estate growth, particularly in high-demand markets like Pacific Palisades. Traditional lenders often shy away from unconventional or distressed properties, but Marquee Funding Group’s asset-based underwriting allows for speed and flexibility where banks cannot.

At Marquee Funding Group, we pride ourselves on being a trusted partner to borrowers and investors alike — offering real estate-backed financing solutions that empower clients to seize opportunities, build wealth, and transform properties. This Pacific Palisades deal highlights not only our speed and flexibility but also our commitment to fostering successful real estate ventures across California.

Marquee Funding Group is pleased to announce the successful funding of a $7,500,000 bridge loan in Beverly Hills, California, reflecting our continued ability to deliver fast, flexible, and high-value private money solutions for borrowers with complex financial needs.

This deal was structured as a 1st trust deed at a 60% loan-to-value (LTV) with a 12% interest rate, designed to balance investor security with an attractive yield. The transaction served as a bridge loan to refinance a maturing hard money loan, providing the borrower with the crucial time needed to exit via a pending liquidity event.

Unlike traditional lenders that often cannot move quickly on time-sensitive refinances, Marquee Funding Group stepped in with efficiency and expertise — ensuring a seamless funding process that met the borrower’s tight timeline. By offering an equity-based lending structure, Marquee was able to assess the asset’s value and borrower’s broader financial picture, rather than relying solely on rigid underwriting requirements.

The loan was originated by Max Stone and V Sevani, who worked collaboratively with the borrower to craft a deal that met immediate cash flow needs while maintaining long-term financial flexibility. Their deep experience in structuring complex transactions once again demonstrates why Marquee Funding Group is a trusted partner for borrowers and investors alike.

This Beverly Hills bridge loan underscores Marquee’s core mission: to provide strategic lending solutions that help clients navigate transitional financial moments with confidence. Whether it’s refinancing a maturing loan, funding a purchase, or leveraging equity for growth, Marquee’s team consistently delivers results — fast, secure, and customized to each borrower’s needs.

Through transactions like this, Marquee Funding Group continues to set the standard in private money lending, combining speed, integrity, and innovation to empower borrowers and investors across California’s dynamic real estate market.

Marquee Funding Group is excited to announce the successful funding of a $250,000 private money loan secured by an owner-occupied property in Bolinas, California. This deal highlights Marquee’s continued commitment to providing flexible, real-world financing solutions that empower homeowners to take control of their finances and achieve greater stability.

The loan was structured as a 2nd trust deed with a 42.78% loan-to-value (LTV) ratio, reflecting a conservative underwriting approach and strong collateral position for investors. The borrower secured financing at an interest rate of 11.5%, offering a balanced structure that benefits both the borrower and investor alike.

The loan proceeds were used for debt consolidation, allowing the homeowner to simplify multiple high-interest obligations into a single, manageable payment. Debt consolidation loans like this one provide homeowners with the opportunity to regain financial control and improve monthly cash flow—particularly when traditional lenders are unable or unwilling to assist due to income documentation requirements or credit limitations.

This transaction was expertly originated by RJ Solovy and Jackie Astman, who worked collaboratively to design a lending solution tailored to the borrower’s needs while maintaining investor confidence. Their experience and dedication are emblematic of Marquee Funding Group’s hands-on, relationship-driven approach to private lending.

With a focus on speed, flexibility, and integrity, Marquee continues to lead the California private money market by providing financing options that make sense for borrowers and investors alike. Whether for debt consolidation, business purposes, or investment opportunities, Marquee’s private lending programs are designed to deliver results efficiently—without the red tape of traditional banking.

This Bolinas transaction underscores Marquee Funding Group’s expertise in crafting custom private money solutions that help borrowers build financial freedom while generating secure, well-structured returns for investors.

This transaction demonstrates Marquee’s ability to deliver practical, efficient, and borrower-focused financing solutions that address real-world financial challenges.

The loan was structured as a 2nd trust deed with a 64.29% loan-to-value (LTV) ratio, ensuring strong collateral protection for investors while offering the borrower much-needed financial relief. The note carries an interest rate of 11.75%, balancing borrower accessibility with attractive investor returns.

The loan proceeds were used to pay off credit card debt incurred through attorney legal fees, providing the borrower with a clean slate and renewed financial flexibility. Traditional lenders typically do not extend financing for these types of situations, especially when personal or legal obligations are involved. By leveraging the flexibility of private money lending, Marquee was able to provide the borrower with a fast, secure solution to manage and consolidate debt efficiently.

This transaction was originated by Eric Baehr, whose experience and attention to detail ensured the deal was structured to align with both the borrower’s needs and investor protections. His ability to handle sensitive and unique financing scenarios reflects Marquee Funding Group’s expertise in private lending and its commitment to delivering results when conventional options fall short.

This Fremont funding illustrates the power of private money loans to provide practical, real-world financial solutions. By focusing on equity, speed, and borrower intent—rather than rigid credit or income restrictions—Marquee continues to bridge the gap between traditional banking and flexible private lending.

Marquee Funding Group is pleased to announce the successful funding of a $240,000 private money loan in Modesto, California. This transaction highlights Marquee’s expertise in structuring customized private lending solutions that help business owners strengthen their financial position and fuel continued growth.

The loan was secured as a 2nd trust deed with a 64.48% loan-to-value (LTV) ratio, ensuring conservative leverage and a strong equity buffer for investors. With an interest rate of 12%, this deal offers attractive returns while maintaining manageable terms for the borrower.

The loan proceeds will be used as reserves for operational growth, providing the borrower with vital working capital to support business expansion, improve cash flow stability, and seize new opportunities. Traditional lenders often make it difficult for business owners to access liquidity quickly—especially when funding is needed for short-term operations or scaling efforts. Private money financing, on the other hand, offers a fast, flexible alternative that prioritizes efficiency and real-world borrower needs.

This deal was originated by Eric Baehr, whose experience and strategic insight ensured the loan was structured to balance the borrower’s goals with investor protections. His ability to deliver timely and creative financing solutions underscores Marquee Funding Group’s ongoing commitment to bridging the gap between conventional banking and modern entrepreneurial demands.

The Modesto loan exemplifies how Marquee’s private lending platform empowers small business owners and property investors alike. By leveraging equity efficiently, borrowers gain access to quick capital that drives growth, while investors benefit from well-secured, income-generating opportunities.

With a focus on flexibility, speed, and conservative underwriting, Marquee Funding Group continues to set the standard for private money lending throughout California and beyond.

Marquee Funding Group has successfully funded a $467,000 private money loan in Ojai, California, further showcasing the firm’s ability to provide tailored financing solutions to meet borrowers’ evolving needs.

This loan represents a rewrite of an existing loan with Marquee Funding Group, offering the borrower an updated structure to better align with their current financial goals. Funds will be used to pay off an existing 1st TD and pay off unpaid property taxes. By leveraging private capital, the borrower was able to secure fresh terms quickly and efficiently—something that traditional financing channels often cannot deliver.

The loan was secured in a 1st trust deed position at a 58.38% loan-to-value (LTV) ratio, providing strong collateral backing and an attractive equity position for investors. With an 11% interest rate, the deal balances borrower access to liquidity with competitive investor returns, demonstrating the strength and sustainability of private lending in today’s market.

This transaction was originated by Maxwell Stone of whom played a key role in ensuring the borrower’s refinancing needs were met with speed and precision. His expertise highlights Marquee Funding Group’s collaborative approach to structuring solutions that serve both borrowers and investors.